Senator Grassley Backs Whistleblower in Major Tax Case

Senator Charles Grassley (R-Iowa), Chairman of the Senate Judiciary Committee, filed an amicus curiae brief in a closely watched tax whistleblower case before the U.S. Court of Appeals for the District of Columbia. The case, Commissioner of Internal Revenue v. Whistleblower 21276-13W concerns the right of a confidential tax whistleblower to obtain a reward based on a criminal tax case. The case will set nation-wide precedent concerning the scope of the IRS whistleblower law.

The government argued that two whistleblowers who exposed criminal tax fraud, and were the key witnesses against the corporate-fraudsters, were ineligible for a reward because the federal government criminally prosecuted the tax cheats. The government argued that only smaller, non-criminal cases were eligible for rewards.

In his amicus brief Senator Grassley, the principal sponsor of the tax whistleblower law, argued that the informants in this case made “precisely the types” of whistleblower disclosures the law as “intended to generate.” According to Senator Grassley:

“The strongest whistleblower cases are those in which the alleged misconduct is so egregious and the information supplied by the whistleblower is so overwhelming that the government can bring a criminal prosecution to enforce the tax law. These are precisely the types of whistleblower cases that the 2006 amendments were intended to generate. . . . By contrast, if the term ‘collected proceeds’ is interpreted narrowly to exclude criminal fines and forfeitures, whistleblowers will be discouraged from reporting major tax fraud.”

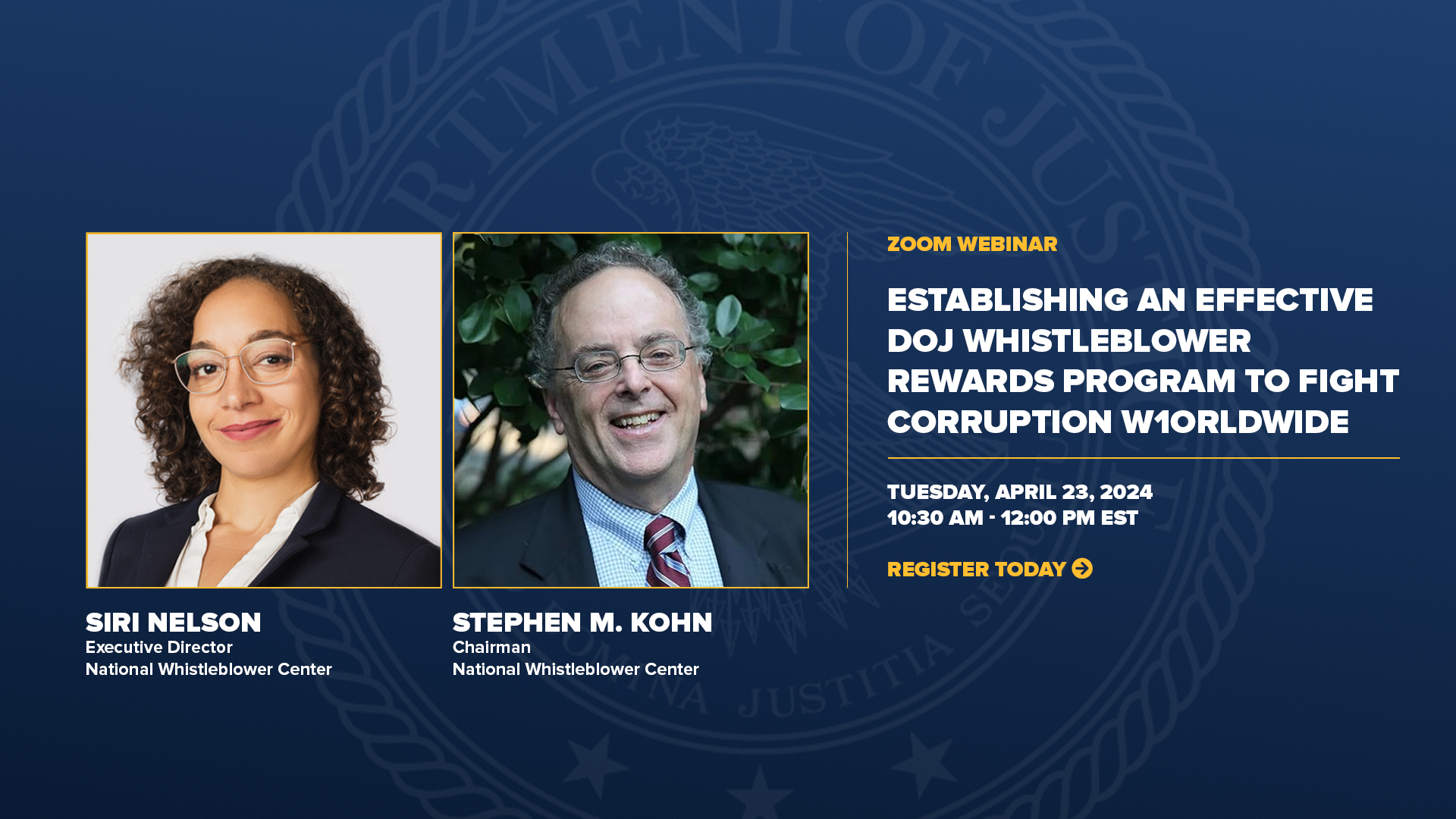

“Senator Grassley has once again stood up for whistleblowers. He understands the danger in the government’s arguments, and how excluding criminal tax cases from the tax whistleblower law would have a devastating impact on the ability of the government to police the biggest tax cheats,” said Stephen M. Kohn, one the whistleblower’s attorneys.

The whistleblowers in this case are represented by Stephen M. Kohn from Kohn, Kohn and Colapinto, and Dean Zerbe from the law firm of Zerbe, Miller, Fingeret, Frank & Jaav. Kohn and Zerbe also serve, pro bono as the Executive Director and the Senior Policy Analyst of the National Whistleblower Center.

Important Links:

- Brief of Senator Charles Grassley as Amicus Curiae in Support of Appellee

- Brief filed by the Whistleblower in the Court of Appeals

- Tax Court decision ruling in favor of the whistleblower: 147 T.C. No. 4 – Whistleblower 21276-13W v. CIR (Aug. 3, 2016)

- Prior Blogs on IRS Whistleblower Issues

- IRS Whistleblower Resources