Our Success

Our whistleblower attorneys are recognized for winning the largest whistleblower rewards in history

$70 Million

Our firm leads in the number of awards given to multiple non-U.S. citizen FCPA whistleblowers, amounting to over $70 million.

Top 10 SEC Awards

We have prevailed in multiple SEC whistleblower cases, resulting in over $125 million in final rewards.

$135 Million

Our firm obtained the largest award ever paid to a whistleblower in multi-jurisdictional anti-corruption cases (combined DOJ and IRS).

“The only lawyer on my side was Stephen M. Kohn. He was as smart as they come and feisty as a pit bull. Steve was convinced the government owed me a fat reward, and he was going to get it, or die trying.”

“Most law firms it really is all about billable hours. For these guys it’s all about the justice.”

“They fought tooth and nail for me.”

“We would like to express our appreciation for all your efforts. Whatever the outcome, your perseverance and conviction on our behalf means so much to us. You both have been supportive, honest and dedicated when no one cared to listen. You are both exceptional. We thank you sincerely…”

About Our Firm

The most respected whistleblower attorneys in the world

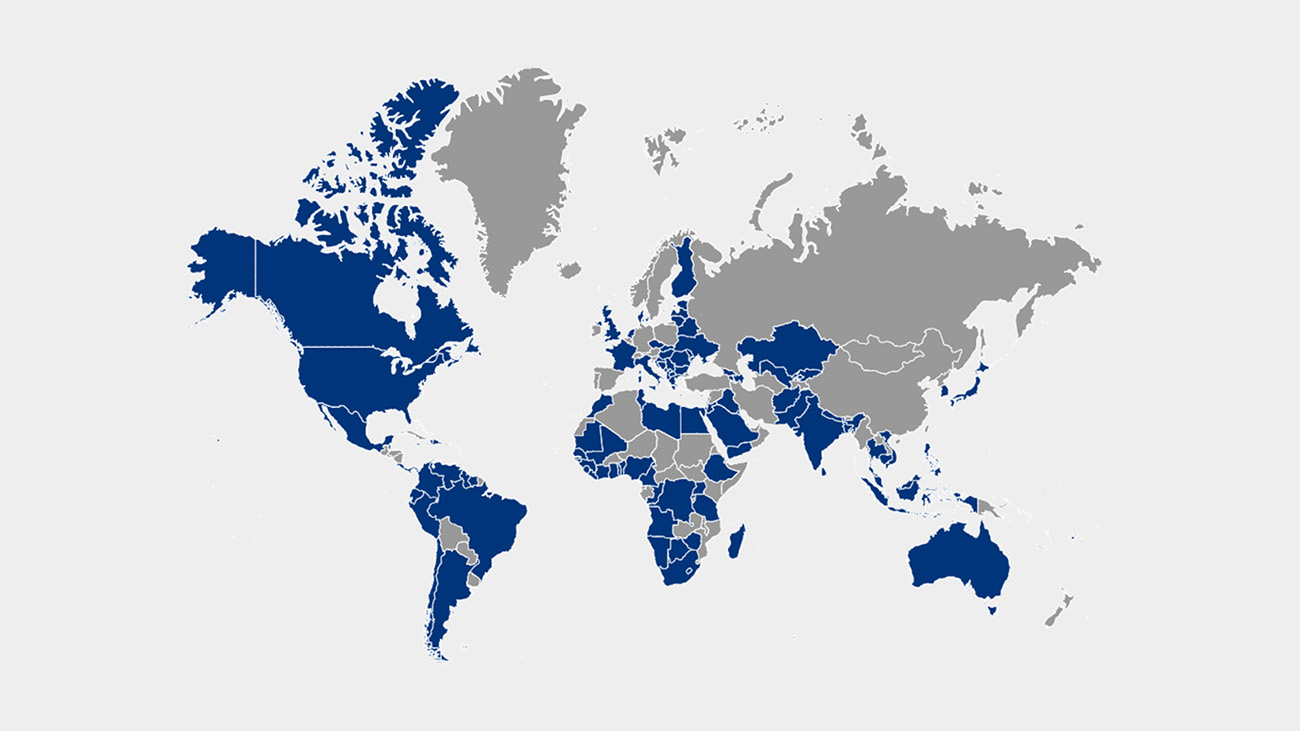

International Whistleblower Attorneys

Our practice is solely focused on protecting and obtaining rewards for global whistleblowers and others who report fraud and misconduct. We specialize in federal contracting fraud, securities or commodities fraud, tax fraud and evasion, and foreign bribery cases.

Practice Areas

Our firm represents U.S. and international whistleblowers

PRO BONO

We wrote the rules on whistleblowing and advocate for stronger laws

Insights

Read whistleblower and qui tam news from our firm

Published on April 25, 2024

Featured In